At Sekondary, we understand the need for a streamlined and effective process for institutional investors to acquire shares in promising startups. Our mission is to provide you with a secure, intuitive, and user-friendly platform for purchasing shares through secondary market transactions, often at attractive discounts.

The Sekondary Advantage for Institutional Investors

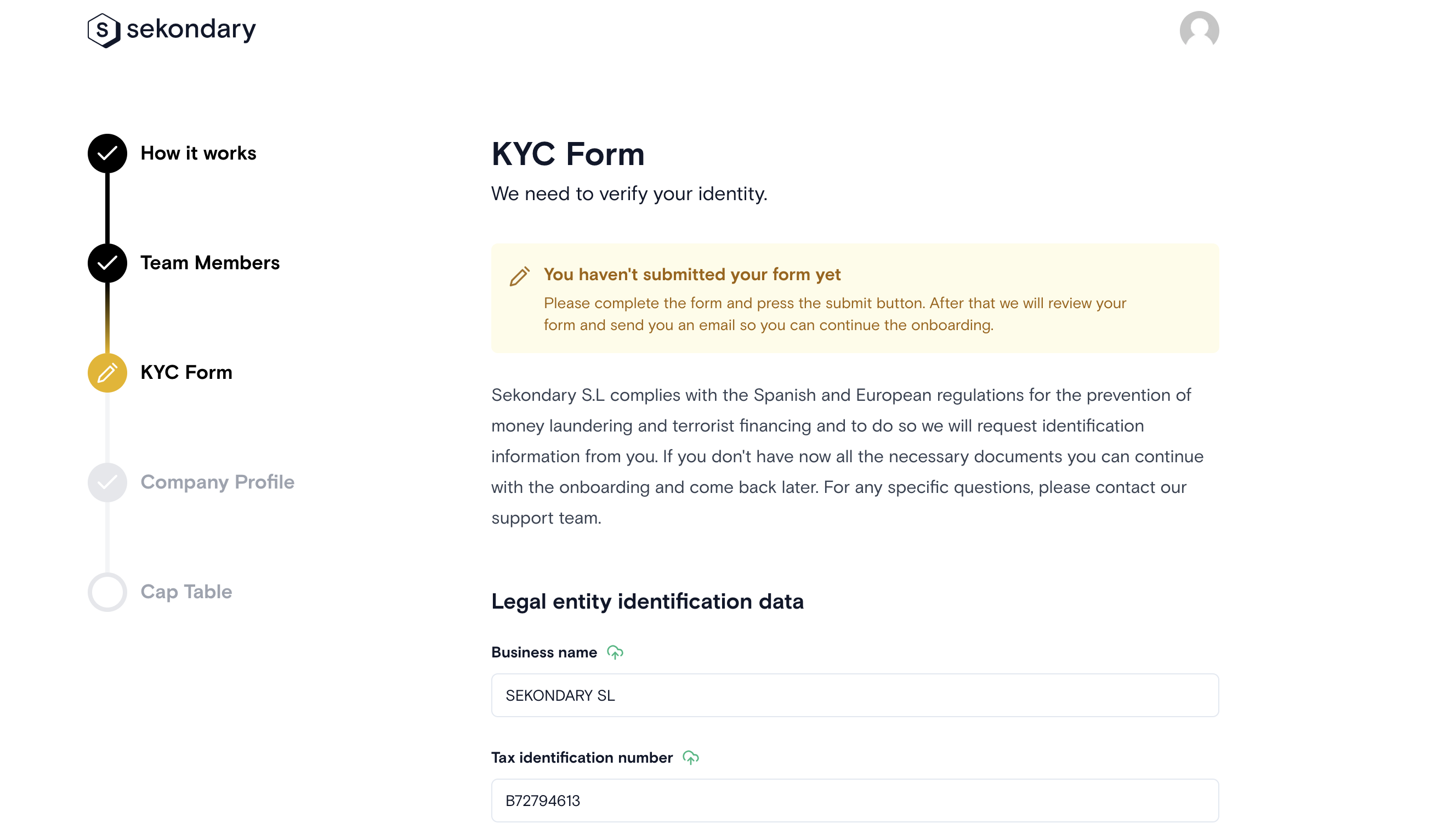

Sekondary's user-friendly platform simplifies the process of buying shares. With a clear, step-by-step guide, institutional investors can efficiently navigate the entire process, from registration to completion of purchases, saving valuable time and resources.

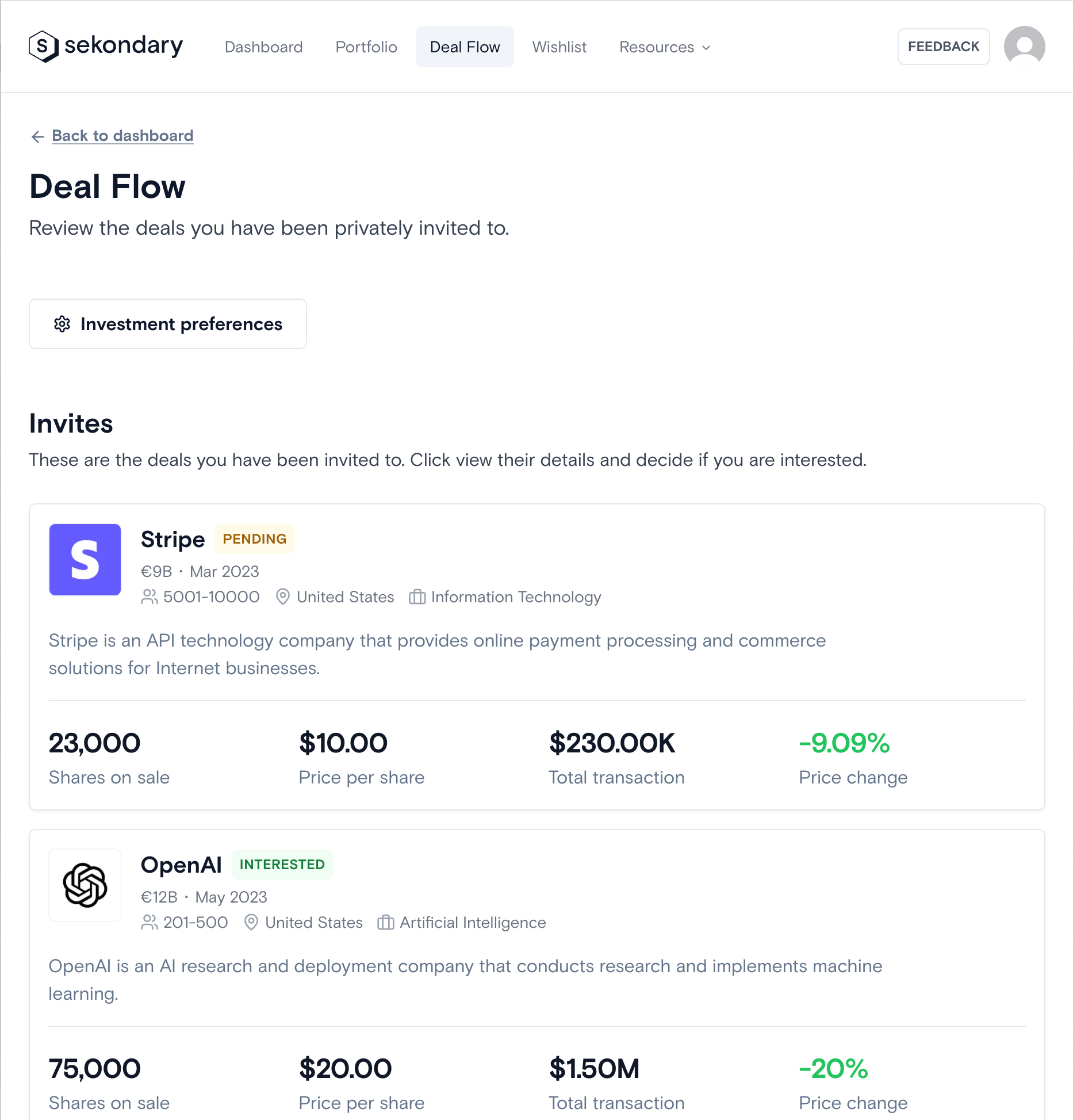

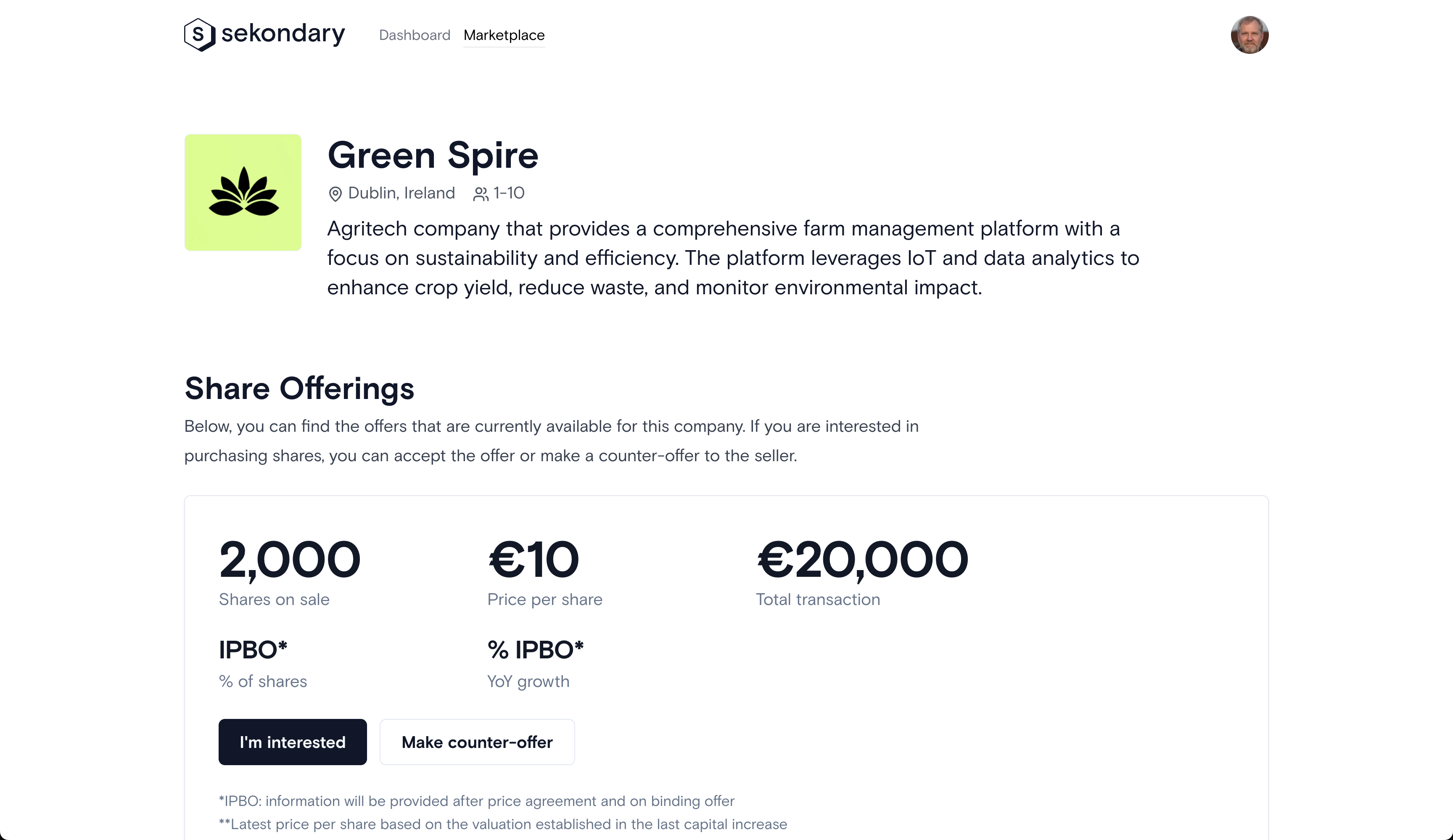

Gain access to Sekondary's expansive marketplace, which provides institutional investors a wide array of startups and scale-ups. This broad network can help you find potential investment opportunities, thereby widening the scope for successful share purchases.

Our secondary market often enables institutional investors to acquire startup shares at discounted prices. This provides the potential for higher return on investment.

Four Steps Guide for Institutional Investors on Sekondary.com: