Why Sekondary? In today's fast-paced ecosystem, startups and scale-ups require efficient tools and platforms that simplify capital dynamics while maximizing opportunities for liquidity. Sekondary bridges this gap, offering tailored solutions that empower companies to focus on what they do best - innovate and grow.

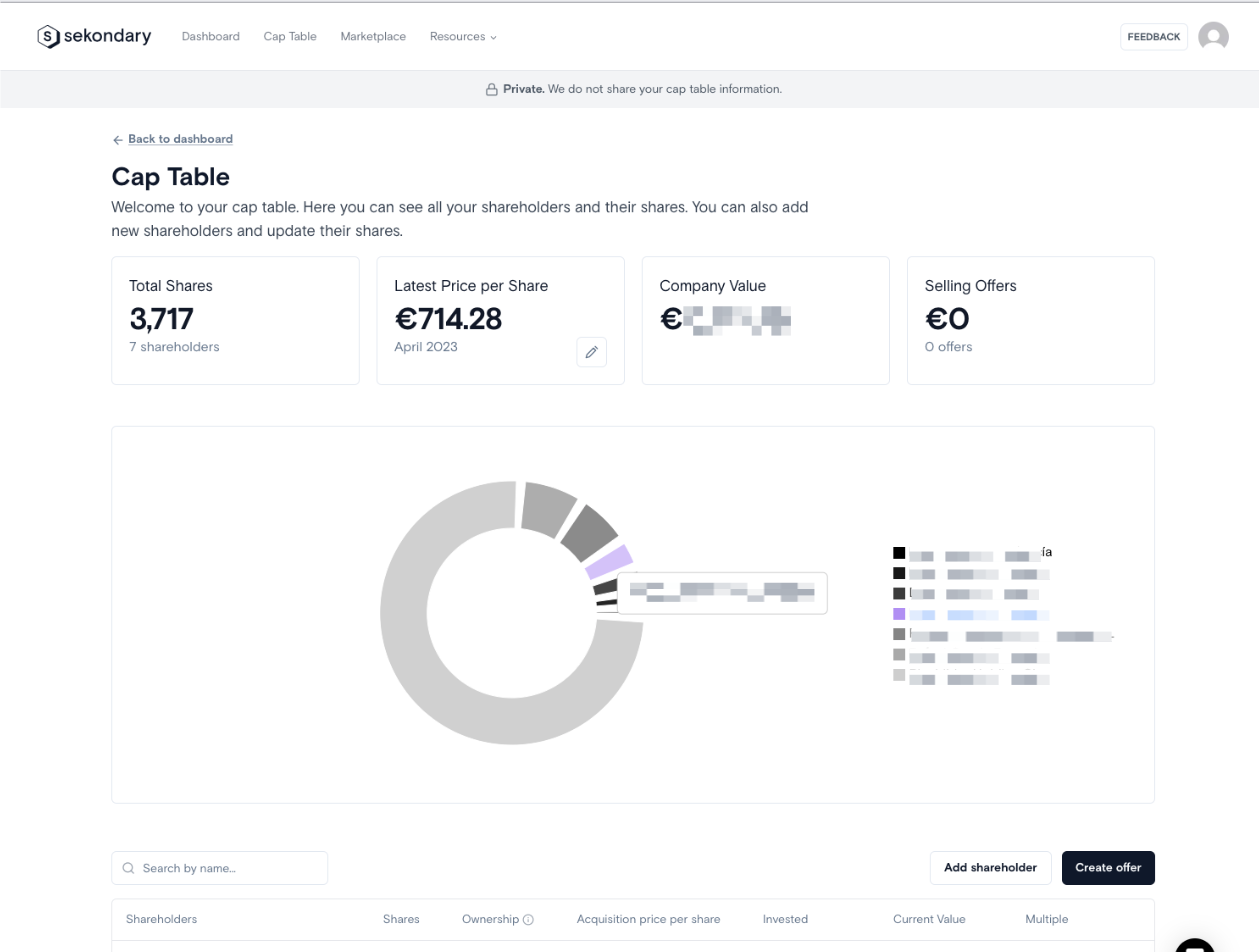

Optimized Equity Management: Over time, companies can accumulate a diverse set of minority shareholders, leading to a fragmented cap table. With Sekondary, facilitate secondary transactions to transition away from these scattered minority positions, streamlining your equity structure. This cleanup process ensures clearer communication, reduced administrative complexity, and a more attractive proposition for potential investors or acquirers.

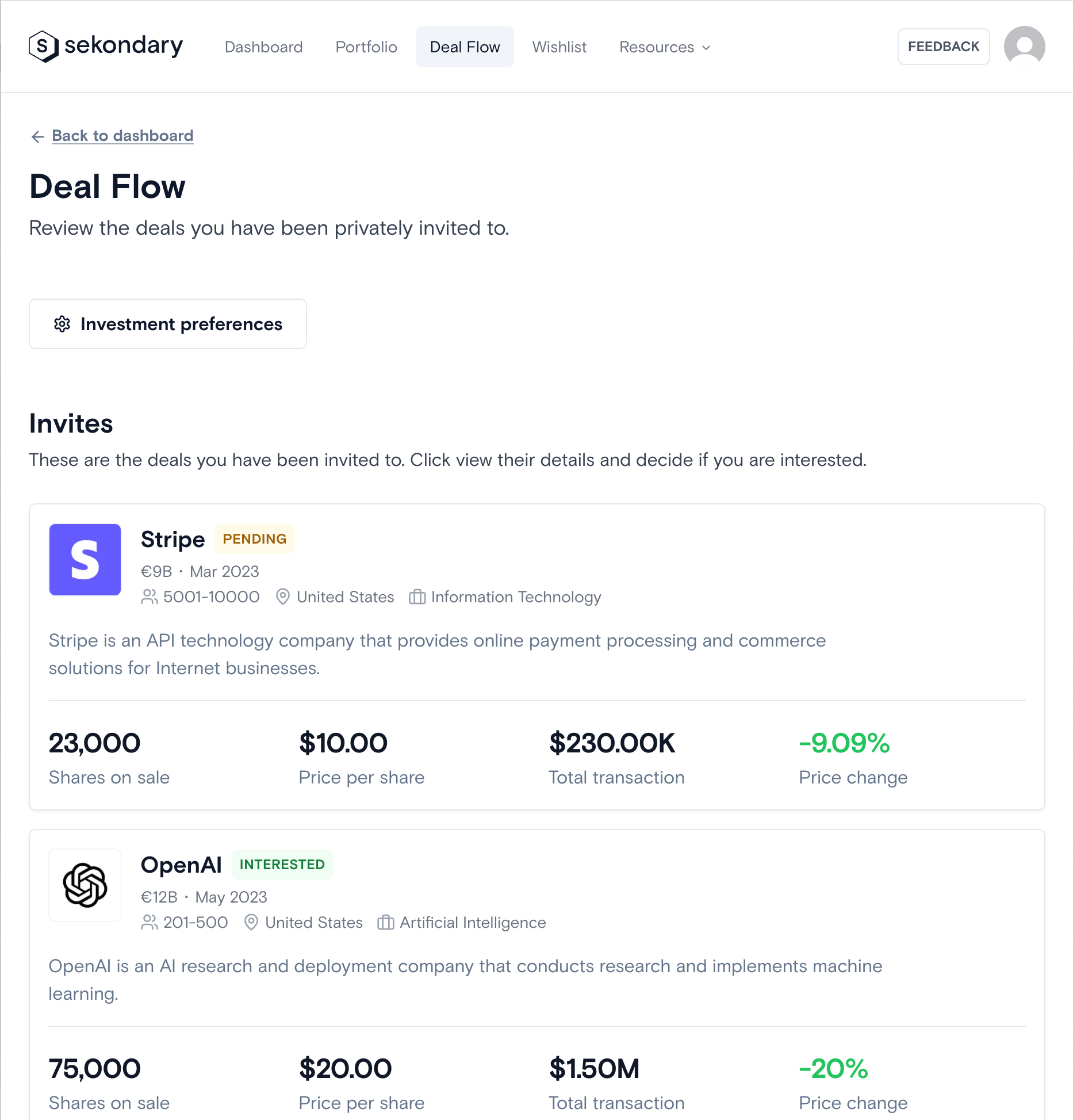

A company can utilize Sekondary to launch primary share offerings to a large pool of investors, facilitating direct contact on the platform.

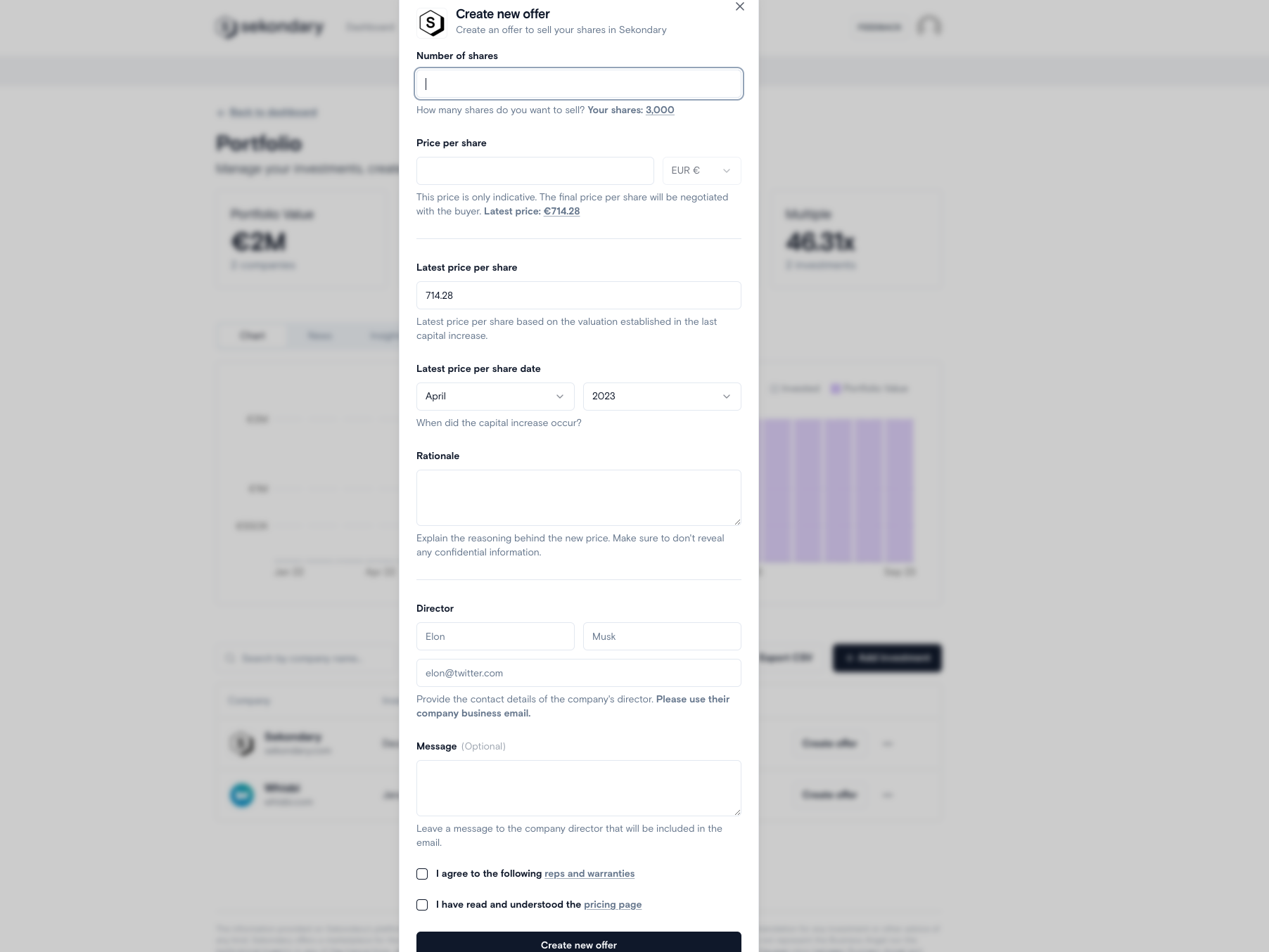

Tailored Secondary Offers: Design and access specialized secondary market opportunities encompassing a variety of stakeholders Strategic Investor Integration: Replace smaller shareholders with institutional investors or VCs who bring not just capital, but valuable expertise and support for your future fundraising and strategic planning.