Providing liquidity to great startups and scaleups early investors and business angels

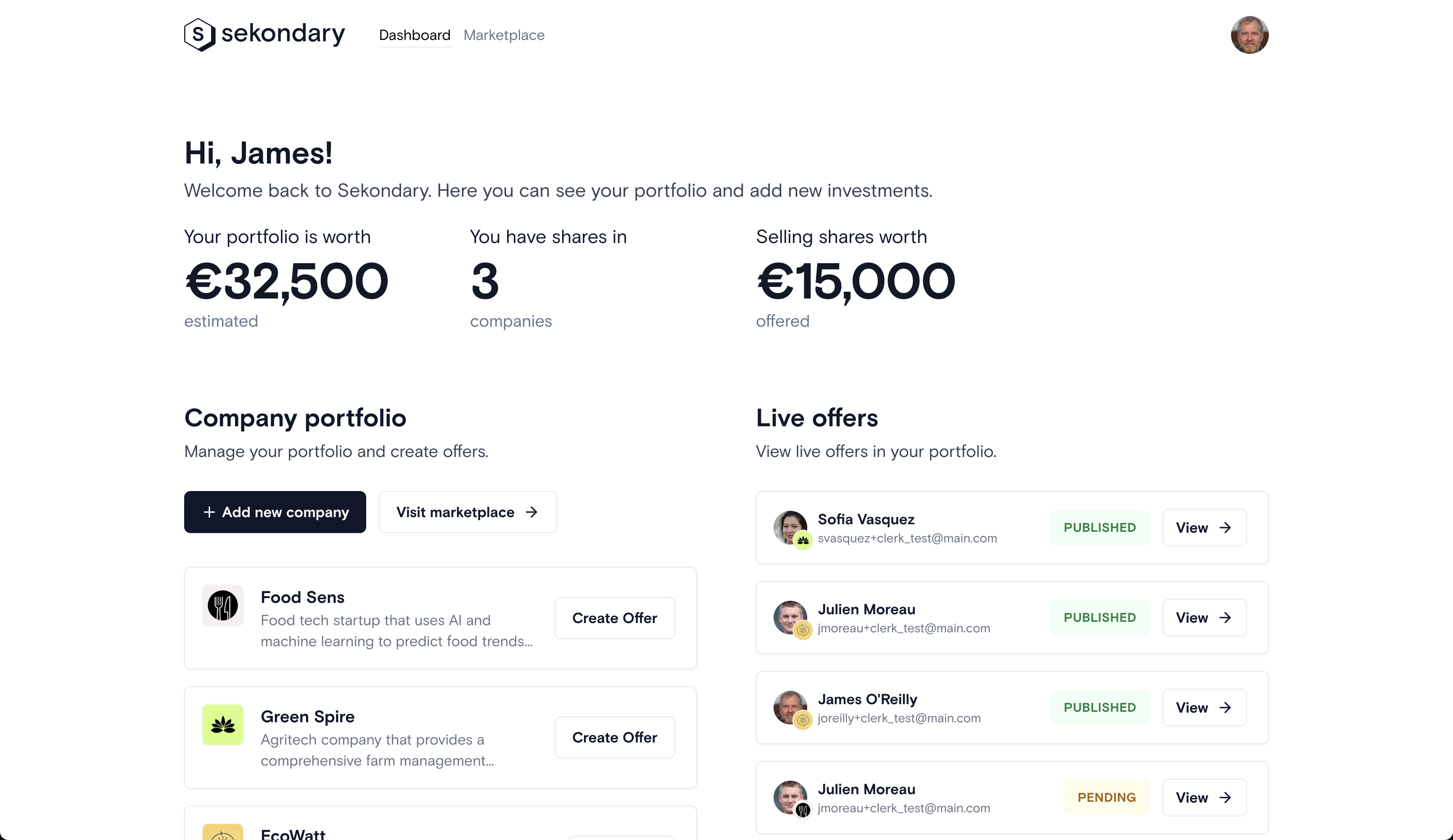

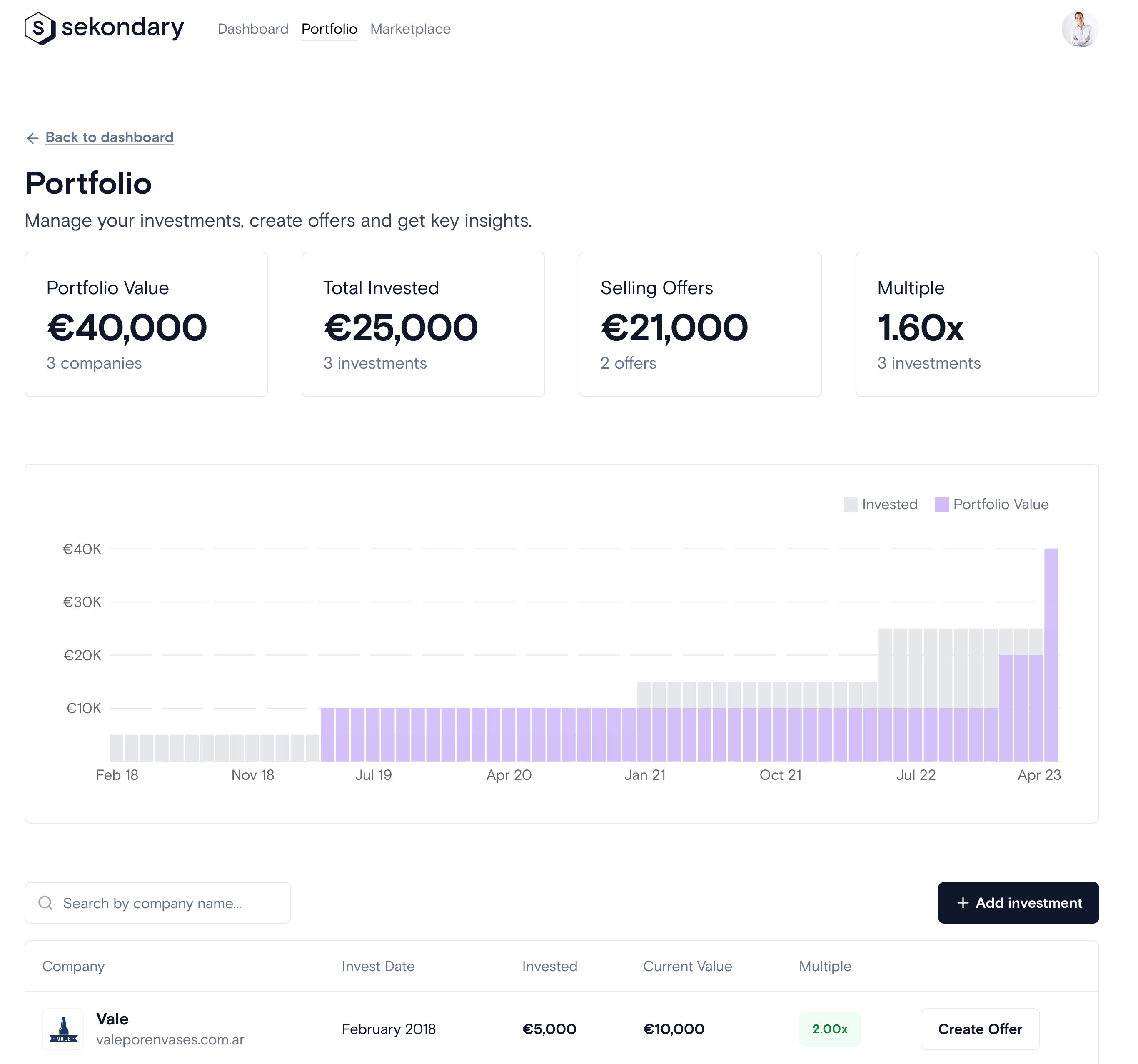

Sekondary stands at the forefront of innovation, facilitating liquidity and streamlining investment management for Business Angels. With our suite of optimized tools, we connect Business Angels to internal shareholders and a network of new institutional investors. Sekondary provides the foundation for strategic decision-making, effective investment management, and rapid access to liquidity.

A Guide for Business Angels

Step 1: Onboarding:

The Business Angel initiates their journey by registering on the Sekondary platform, providing necessary details. Our system conducts KYC/KYB checks during this process to ensure regulatory compliance. Once registered, Business Angels can create portfolios and generate sale offers.

Step 2: Engaging with Startups:

Generated offers are sent to the respective startup CEOs. The company then has two choices - to collaborate by sharing the offer with shareholders or not to engage. Regardless, if there's no internal interest, the Business Angel has the liberty to post the offer on our private marketplace.

Step 3: Activating the Marketplace:

Upon completing the above steps, Business Angels can list their offers on the marketplace. They need to provide essential details like the number of shares for sale, last round price, and the discount. Agreeing to provide accurate information under Reps & Warranties to potential acquirers is mandatory, holding the business angel responsible for any misinformation. Once offers are live, professional investors can start submitting their binding offers.

Step 4: Receiving a Binding Offer:

The actual power and decision-making process for a Business Angel kick in upon receipt of a binding offer for their equity stake in a startup. It presents a unique opportunity to consider liquidating your stake based on the potential returns from the offer and your assessment of the startup's future prospects.

Step 5: Exercising Pre-emption Rights:

After receiving a binding offer, the company communicates the offer to its shareholders who can exercise their pre-emption right. Accepted offers are forwarded to the company CEO, and internal shareholders registered on the platform are informed of the sales offer. They can then decide whether to exercise their pre-emption rights or not.

Step 6: Executing the Sale:

If internal investors cover the offer, the sale is executed. Our platform guides the involved parties through the transaction process. The sale is finalized in front of a notary to officially formalize the transfer of shares. If internal shareholders do not cover the sales offer, the business angel and the external buyer who signed the binding offer proceed to finalize the sale, again signing in front of a notary.

How does Sekondary's model align with European regulations regarding secondary markets?

Sekondary operates in accordance with European regulations on secondary markets. Our platform is distinct based on two key features:

Does Sekondary focus on shares of publicly traded companies or only non-listed ones?

Our primary focus is on listing offers related to equity shares in limited companies, meaning non-publicly traded entities.

How do pre-emption rights work?

Pre-emption rights are a clause that allows current shareholders of a company to have the first option to buy new shares before they are sold to outsiders. When a Business Angel wants to sell their shares, internal shareholders are informed, and they have the opportunity to buy these shares first.

How does Sekondary handle the "Tag Along" when there's a purchase offer for a minority shareholder?

The “Tag Along”, allows minority shareholders in a company to sell their stakes concurrently with key or reference shareholders. At Sekondary, if a purchase offer emerges for a minority shareholder, it’s vital to review the existing shareholders’ agreement. Notably, in minor sales, such as those representing less than 5% of total shares, this right might not be applicable. If the agreement allows, other shareholders could opt to join the sale in proportion to their stakes. However, if more shareholders are keen on selling, the investor might not be willing to expand their offer, leading the initial minority shareholder to sell fewer shares than initially intended. At Sekondary, our focus is to maximize value for our users. If this situation arises, we’d conduct a comprehensive case analysis and adjust our commissions to ensure benefits for all parties involved.

What happens if I can't sell my shares to internal shareholders?

If you can’t sell your shares to internal shareholders, Sekondary will communicate the share sale to our external investor network through our marketplace. This way, we increase the chances of you being able to sell your shares timely and efficiently.