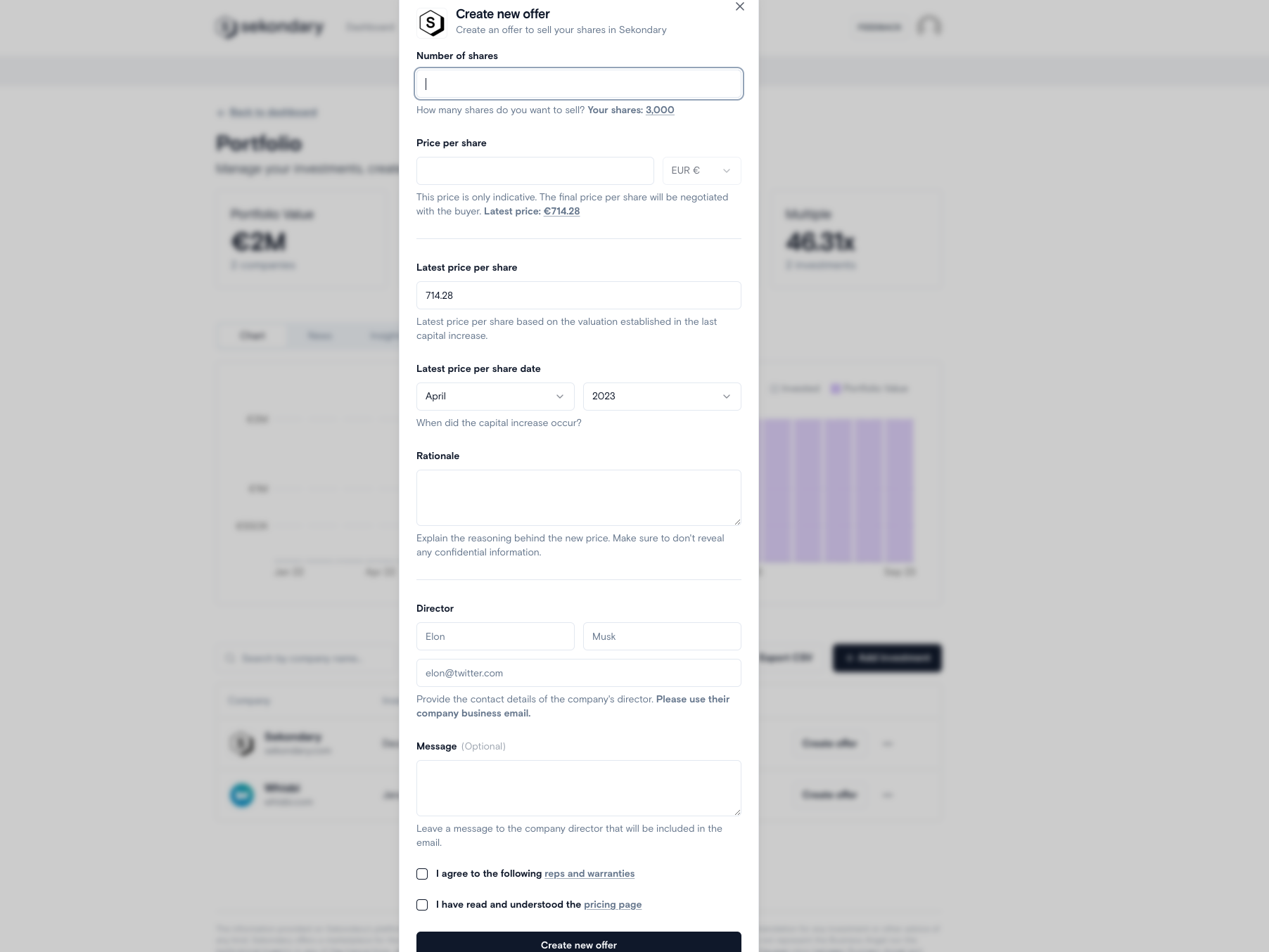

Program your customized liquidity windows to offer liquidity to your key employees

Our platform offers liquidity, visualization, and tax optimization of the right to receive shares in a company through Employee Stock Option Plans (ESOPs) and phantom share plans.

Liquidity

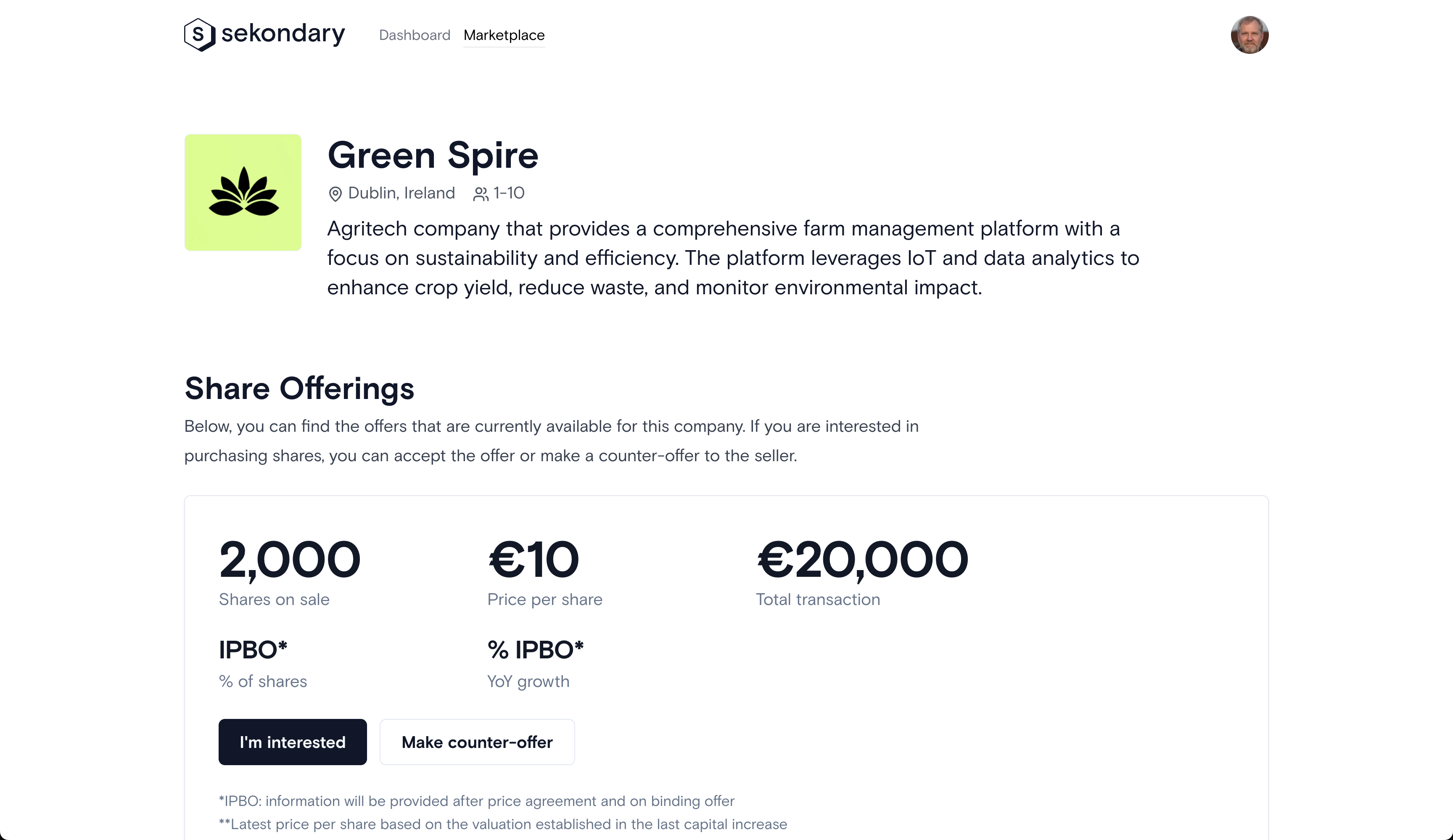

By digitizing the right to receive shares through an ESOP and utilizing a unique financial mechanism, Sekondary offers employees enhanced liquidity through liquidity windows. This allows them to partially sell their rights to shares on the secondary market more swiftly than with traditional ESOPs. This provides additional flexibility and access to cash for personal needs while retaining a portion of their equity.

ESOP value visibility

Sekondary's approach to digitizing equity enhances value visibility for employees by clearly representing their equity's worth. With the introduction of liquidity windows, employees can easily track the value of their partially owned shares. This promotes better understanding and engagement with their equity, fostering a stronger connection with the company's growth and success.

Tax efficiency

Sekondary's innovative approach to digitizing the right to receive shares can offer tax efficiency for employees. Our unique financial mechanism enables companies to cover the tax liability associated with the shares, reducing the tax burden on employees. Furthermore, with the application of liquidity windows, employees may benefit from lower capital gains tax rates if they hold their shares for a specified period, further enhancing the tax efficiency of the equity arrangement.

Cost-effective

Utilizing Sekondary's unique financial mechanism to fund an ESOP can help companies minimize or eliminate costs associated with traditional fundraising methods like IPOs or venture capital. This approach makes launching an ESOP more cost-effective and financially efficient.

Enhanced Talent Retention

Sekondary's approach to digitizing the right to receive shares through an ESOP offers employees valuable incentives, such as enhanced liquidity, transparency, and tax efficiency. This helps companies retain top talent while boosting morale and employee motivation.

New Motivational Tool

Digitized rights to receive shares through ESOPs enable companies to explore novel ways to motivate and reward employees. By creating tailored rules and liquidity windows tied to specific objectives, companies can incentivize employees to improve overall performance and drive growth.

The ESOP digitization process at Sekondary involves the following steps: